AlphaNet Economics Litepaper

1. The Value and Differentiation that AlphaNet Brings to the Table

In talking about AlphaNet, first and foremost we shall first bring up the most important and relevant concept – the notion of "alpha". What we mean by alpha is essentially the edge or advantage that can be gained over the market on a risk-adjusted basis via any form of investing, trading, or risk-taking. In layman’s terms, the higher the alpha, the better the opportunity and risk-adjusted profit-making ability any investment approach has.

AlphaNet is a platform whose goal is democratization of alpha-generating AI capabilities for traders, built on Phoenix, focused on the crypto market. With over 10,000+ hours of research & development combined with extensive proprietary know-how, meticulous AI model research, experimentation, and training, AlphaNet Beta R2 is set to launch with advanced AI capabilities for traders such as ViperAI and WaveML.

This litepaper aims to outline the value and economics side of AlphaNet, and will shed light on why AlphaNet is set to be a truly differentiated player in the space, as well as how it will also propel the Phoenix ecosystem and PHB’s value.

For those who are not familiar with the background premise, vision, and core value proposition of AlphaNet, we encourage you to read the original AlphaNet Litepaper.

Ⅰ. AI Becoming Increasingly Crucial Source of Alpha

As outlined in the original AlphaNet Litepaper - hedge funds, discretionary trading firms and high frequency trading (HFT) groups have a vast edge in the market above retail traders in terms of access to proprietary information, quality data, capital, technology, and talent resources, to name a few. Hence most traders have a hard time consistently generating sustainable alpha over time, or via what we refer to here as "systematic edge".

While sophisticated traders can slightly close the gap via experience, retail-sourced data streams, and leveraging certain tools, one reason in which the gap will continue to widen will be due to – yes you guessed it, AI. With the fast rate that AI models and hardware infrastructure is proliferating among industries, institutional trading is one of the areas where it’s leveraged the most. It’s also one of the areas where AI is the most challenging to use (as the market can be seeing as a complex chaotic system vs. simpler closed system problems such as AlphaGo), but when used well is likely the most profitable among commercial use cases.

In actual implementation, robust AI and machine learning-driven trading systems require an entire pipeline that deal with extensive data cleansing, data (feature) engineering, mathematical modeling, AI model training, signal generation, position sizing, and order execution algorithms. This does not include the costly infrastructure that much of this process runs on, especially if deep learning is involved (and if GPU-based infrastructure is required in general).

This type of pipeline, when implemented adequately in partial or full, is simply not accessible to the vast majority of individual traders – for institutions with adequate resources, they will hone in and continue to build these capabilities (including hoarding infrastructure, such as GPUs), hence widening the gap.

Ⅱ. AlphaNet: the AI Democratizer and Heavy-Lifter

Given this capability gap exacerbated by AI, and the fact that retail cannot likely go via the "proprietary information" route for alpha generation, AlphaNet serves as the platform to bridge the gap and provide individual traders technology originally deemed inaccessible previously due to barriers to entry, resources and costs. AlphaNet is built to not only provide its users opportunities, signals, and ad hoc insights, but an actual "systematic edge" - only a systematic edge is sustainable over time, which is the ultimate goal for any long-term participant in the market.

Led by a team at Tensor Investment, an Asia-based AI proprietary trading firm, as well as support from two other organizations in Phoenix Governance DAO, AlphaNet will be able to make this a reality.

What AlphaNet brings to the table for its user ecosystem is 4-fold:

Data, Technology, and Systems

AlphaNet is an AI pureplay – meaning that all of the offerings, products, and capabilities on our platform revolve around machine learning. As mentioned above, creating effective AI systems for market prediction and trading requires an entire pipeline of processes, starting with data. From obtaining granular millisecond-level exchange data, to knowing how to transform and cleanse the data, to extrapolation which datasets are the most valuable to use in the AI models, AlphaNet has the process covered beginning to end – it’s merely an abstraction to the user.

Next are the research & development of the AI models that drive our offerings in the form of insights, signals, strategies, and tools. These are the capabilities that will drive the alpha for our users. As mentioned earlier, the process is meticulous and resource intensive, and across all our offerings including ViperAI and WaveML already used over 10,000 hours of research & development, much of which involves testing and experimentation. The good news is that, much of this stem from existing knowledge and knowhow of Tensor and other trading firm partners.

Finally, the AI models provide insights or signals that can be delivered to the end-user in an easily consumable format, including AlphaNet’s chart GUI, text/telegram notifications, or API service (more in detail below).

Infrastructure and Scaling

Other than the data processing and R&D, there’s the scaling aspect of AI. Offerings such as ViperAI and WaveML all run on deep neural networks (DNN), sometimes multiple DNNs for each model, which utilize distributed GPU computing when run at scale. Model parameter optimization and exploration at times requires thousands of iterations training a model with over a year’s worth of data.

Hence, with AlphaNet running on Phoenix Computation Layer, which scales these processes easily with decentralized GPU-enabled compute, users never have to worry about the scalability aspect of AI when it comes to AlphaNet.

Proprietary Know-how

Leveraging AI for trading to generate alpha is not only about AI and technology itself, but also about proprietary accumulated domain expertise. Understanding market dynamics, where edge and alpha can be found is not something that’s built up in a year or two – this type of expertise needs to be combined with adept use of AI technology in order to achieve an effective edge.

AlphaNet partners with some of the best AI-driven crypto trading shops around Asia to provide our users integrated proprietary know-how in our offerings out of the box.

Virtuous Economic Model

AlphaNet, as a unique type of a platform that provides edge in the market, provides users value within an environment with both zero-sum game characteristics as well as non-zero-sum characteristics, depending on the angle. Naturally, if too many people use the platform, then there likely will be an erosion of alpha, hence a decrease in value for all other participants on the platform.

This is exactly the reason, that when we mention the "democratization" of AI in the markets, we do not mean broad democratization, which would be absurd in this context. What we mean by democratization is actually collective democratization of AI among users of AlphaNet. In order to become a user of AlphaNet and access alpha generation capabilities, one needs to participate in the token economics of AlphaNet and PHB, and build self-preserving value for the ecosystem. This does mean turning down a segment of users whose interests do not align or do not have the minimum resources to participate in the ecosystem.

Hence we will refer to this dynamic as a "virtuous economic model" fueled by a collective. To see how this model works, read on.

2. The Role of AlphaNet in Phoenix Ecosystem

Phoenix’s Web 3-based AI infrastructure is based around real-world utility that can scale and deliver tangible economic value. The role of AlphaNet in the Phoenix ecosystem is a native dApp that would provide transformational value by leveraging AI built on top of Phoenix Computation Layer.

AlphaNet does 3 main things for Phoenix:

Rapidly Grow a Userbase

For sophisticated traders that understand systematic edge or for cognizant traders that who wish to leverage it, a platform such as AlphaNet caters directly towards this audience group. Due to the volatile nature of crypto, the majority of crypto investors are traders in one way or another – for a Web 3-based AI platform there is no better audience and native use case.

Strengthen Phoenix’s Token Economy

With the introduction of the tiered Hybrid Staking mechanism into AlphaNet as one of the core drivers of the token economic model, with adoption it would quickly decrease the amount of circulating PHB and boost utility and value. For the user/staker they would not only see AlphaNet creating value for them via utility but also likely token value appreciation in the process of participation in Hybrid Staking.

Grow the Scale of Phoenix Computation Layer

Phoenix Computation Layer (soon to be upgraded to SkyNet), is an open platform where users can deploy, run, and scale AI models on Web 3-based infrastructure. Given this, other than organic developer user growth, it’s optimal that Phoenix can provide an outlet for adoption that does not require the userbase to touch AI models directly, meaning the users would directly use and consume the AI outputs easily.

In this manner, we would simultaneously grow the infrastructure via both infrastructure users as well as app (AlphaNet) users. This enables us to equivalently run on four legs, helping the infrastructure platform achieve economies of scale by leveraging rapid app-level user growth.

3. Hybrid Staking in AlphaNet

Hybrid Staking is an innovative staking concept coined by Phoenix Core Development back in early this year, and is a concept that spans various modules and features in the Phoenix Ecosystem including Computation Layer and AlphaNet.

The core tenet of Hybrid Staking is that Web 3 tech ecosystems (in this case Phoenix has a ecosystem around decentralized AI) that bring substantial utility value for ecosystem participants should also employ staking in return for utilitarian value, not just for token rewards. This achieves two novel goals for the ecosystem:

Synergizes both holding/investing as well as "using" – in essence it’s forming an alliance between ecosystem participant and the protocol itself. Depending on the use case, there may be a self-preservation element to this mechanism (as in the case with AlphaNet).

Decreases supply flowing in the market, boosting token scarcity – this is essentially a self prosperous mechanism for both the "holder" and "user".

Hybrid Staking in AlphaNet – A Natural Fit

The Hybrid Staking model is a natural fit for AlphaNet for two main reasons – 1) AlphaNet will deliver significant utilitarian value: there are very few use cases in which can surpass delivering alpha and high risk-adjusted profits in terms of actual utility 2) the economics and game theory behind an alpha-generation source requires a degree of self-preservation of a group, or a "collective", to be retained. Hybrid Staking’s positive impact on token value, and subsequently increasing staking tier dollar value threshold, will inherently enhance the self-preservation aspect.

Tiering Rationale – Maximizing Economic Output of AlphaNet as a System

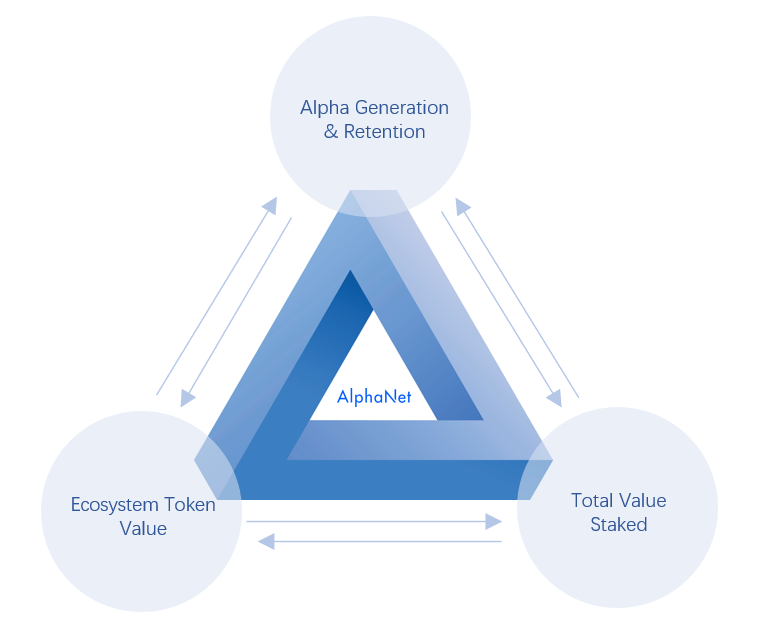

The concept of preserving self-interest of a collective (participants of AlphaNet) is a reoccurring theme within this litepaper. The initial tiering system of AlphaNet is crafted in the manner of maintaining both self-preservation properties and simultaneously maximizing total economic output of the system. In the case of AlphaNet, there’s multiple mutually symbiotic factors at play into factoring into ideal economic output:

Alpha-generation

The ability for the features and offerings on the platform to continue to generate alpha is the first and foremost priority. This is reinforced by continuous innovation, R&D, and scaling of the offerings of the platform. Eventually AlphaNet will have something that caters to every profile of trader. Additionally, but just as important, the tiering system and Hybrid Staking economics serves as an additional self-preserving guardrail of alpha generation.

Total tokens staked

The total tokens staked is an important benchmark signifying the stage and maturity of the ecosystem, as well as the prominence and perceived value in the market as a whole. When total tokens staked via Hybrid Staking reaches a certain level, it would have already made its impact on the token economics of AlphaNet, Phoenix Ecosystem, and PHB.

Ecosystem token value

The market value of PHB also a key pillar of the total economic output of AlphaNet – one thing to remember is that for the user and participant there are two economic outputs 1) the alpha generated via AlphaNet 2) the return on PHB value as it’s getting staked over time. Once 1) is realized by the userbase at a particular scale, 2) is most likely to realize as well. Hence, these three aspects mark the completion of the symbiotic 3-part loop.

So considering this definition of maximum economic output – it makes sense that the goal is NOT to maximize the userbase in terms of pure quantity (other than free users T0), but rather to prioritize these three factors in balance instead.

Each tier’s staking requirement will reflect the extent of value the utility of AlphaNet to the user, and participants who match the value proposition and who are willing to align with the ecosystem will ultimately participate. "Give the core resources to those that need it, and that are willing to pay the right price for it".

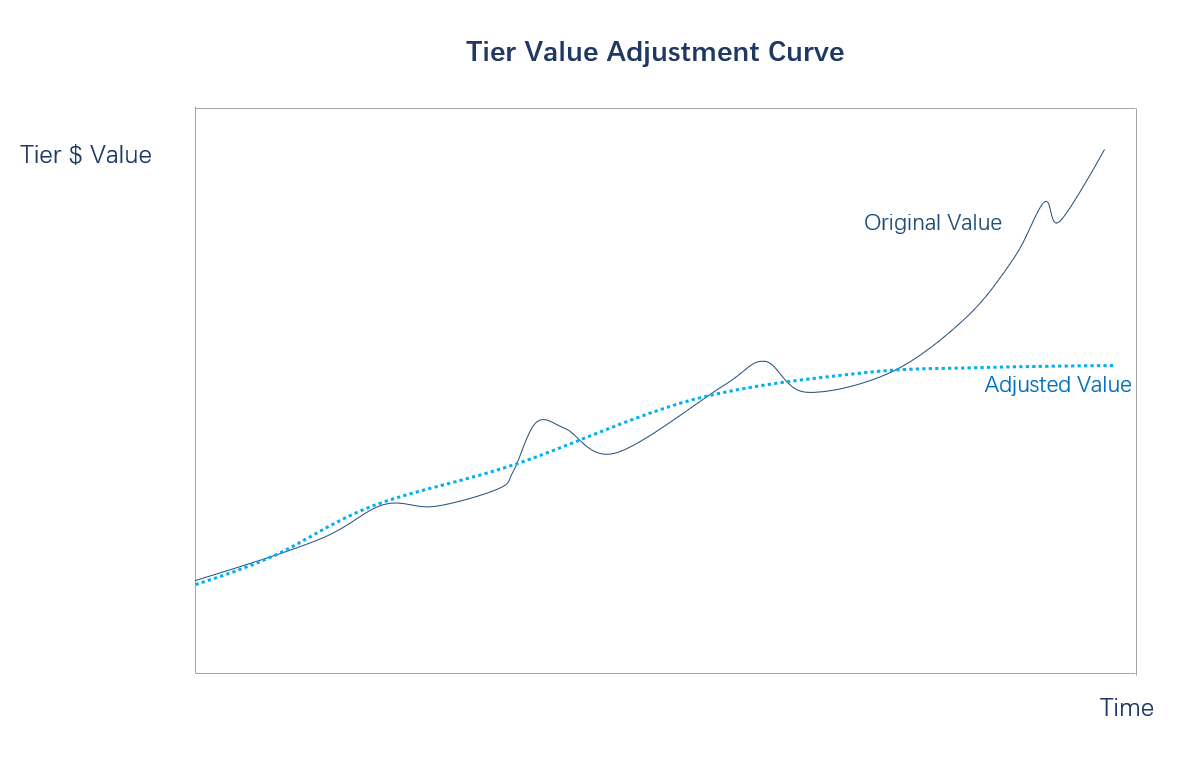

Tier Adjustment Mechanisms

Naturally when tier thresholds when defined in PHB may quickly become unaffordable in cases of significant rise in PHB market value, adjustment mechanisms may take hold. Adjusting tiers for market price increases in PHB in accordance with self-preservation measures and continuing to maximize for total tokens staked will be an important juncture in the growth of the ecosystem.

Naturally, past a certain inflection point, for any particular tier due to the growth of token value becomes unaffordable for more users and only affordable for a smaller demographic. This is normal as this fulfills our self-preserving principle in that the barrier of entry to later participants will be higher and less will be able to access.

Capturing Long-Tail

Long-tail (from the concept of "long-tail" probability) participants of the AlphaNet economics model include users of the Enterprise and Custom tiers in the initial tier structure – these types of users are much scarcer than the bulk of users but provide substantial value for the ecosystem and maximum economic output of AlphaNet.

Capturing a long-tail userbase can be a catalyst for growing the ecosystem and maximum economic output at a rapid pace.

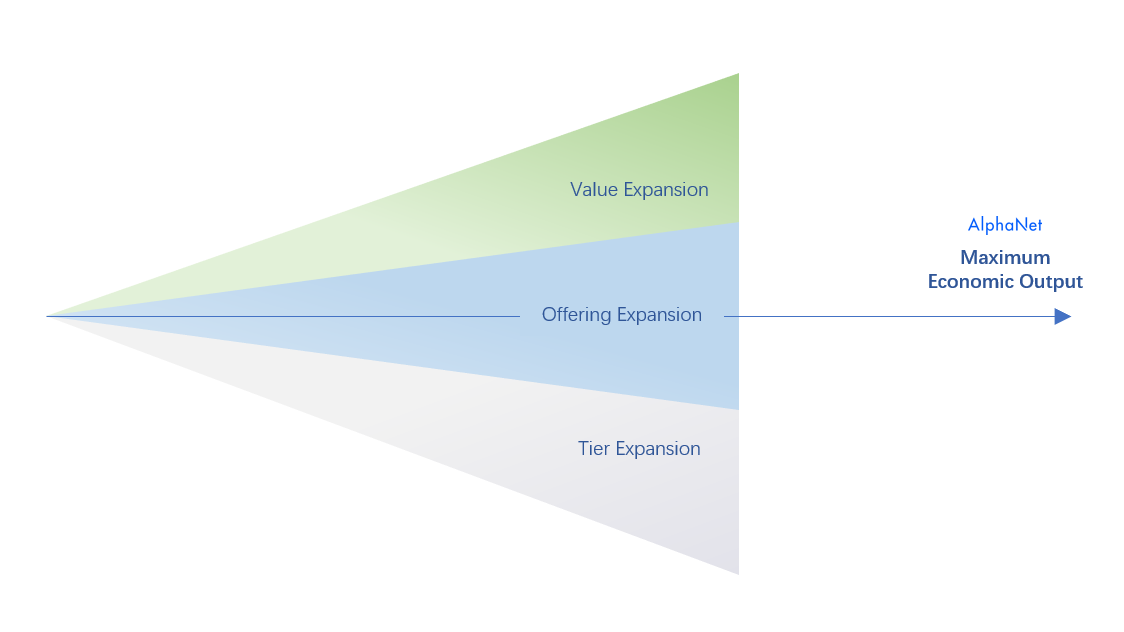

System Expansion

In the ongoing process of growing maximum economic output of AlphaNet, there’s 3 aspects of continuous expansion of the platform:

Value Expansion

To preserve and expand growth and alpha generation capabilities for all tiers (including free), AlphaNet will expand the value per tier, and offerings per tier.

Offering Expansion

To provide an increasingly diverse set of offerings to various different profiles of traders, including with different trading timeframe preferences, an ongoing expansion of our offerings and products will persist.

Tier Expansion

As adoption and maximum economic output of the system grows, to cater to increasingly diverse needs, the number of tiers and options for users will grow.

One thing is clear, to create the effect of maximum economic output from AlphaNet, with also a clear material impact on the Phoenix ecosystem, it does not take much users in terms of quantity, rather than quality, thus demonstrating our notion of an economic model in likes of a self-preserving virtuous cycle - and this just may set a precedent for a new model of an alpha-generating collective.

Last updated